Why must I thought a personal lending company?

What to Learn

- Personal mortgage brokers offer quick-title mortgages as an alternative to the major banks.

- Individual mortgages enjoys high rates of interest and you may fees, but these include convenient and reduced become recognized to have.

- Borrowers which may change for the private loan providers were those with bad credit, people who trust international or unusual earnings source, and you may newcomers La Junta Gardens loans to help you Canada in the place of a position history.

- If at all possible, private mortgages are utilized as the a temporary service while you improve your bank account.

What are individual mortgage lenders?

Individual mortgage lenders is individual firms and other people that provide away their own money. This can include Financial Investment Organizations, in which funds from private traders try pooled to cover syndicated mortgage loans. Individual loan providers do not undertake deposits regarding societal, and additionally they commonly federally or provincially managed.

Private mortgage loans are typically quicker and you can include high rates and you will costs than those supplied by antique mortgage lenders. They are intended to be a temporary size before transitioning back so you’re able to regular mortgage brokers.

Private Mortgage brokers All over Canada

Private lenders features went on becoming an ever more popular alternatives to have residents and get managed an important role from inside the Canada’s houses industry. Considering research regarding the CMHC, non-bank lenders began $ million value of mortgage loans in the 2021.

If you’re close to half that have been away from borrowing unions, there are still 306,000 mortgages originated in 2021 because of the individual lenders, well worth alongside $100 mil. It incorporated home loan financial institutions (MFCs), financial resource agencies (MIEs), and faith companies. There are various lenders where you can rating an exclusive financial away from.

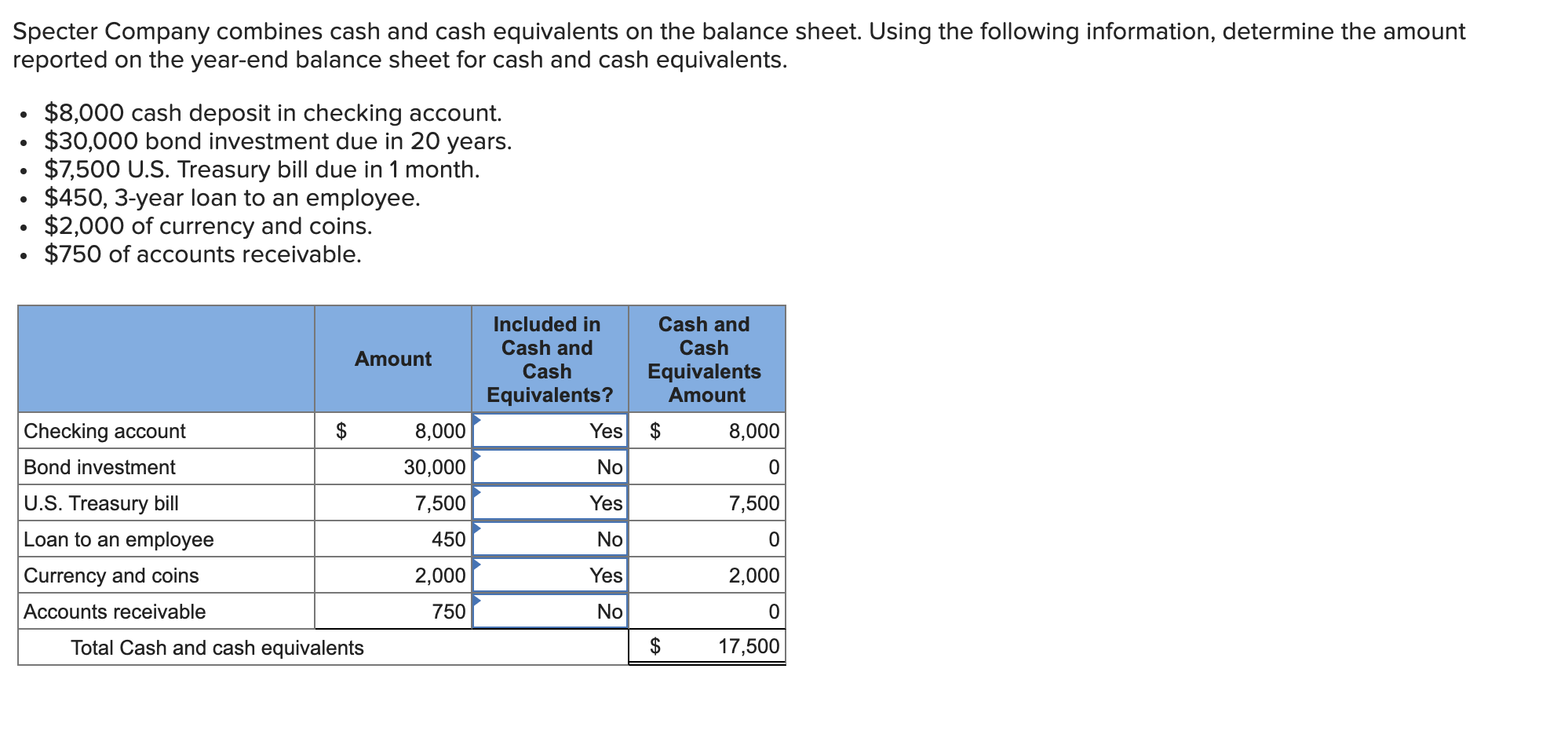

The newest dining table lower than listings a variety of individual mortgage lenders in Canada and you can measures up the private financial pricing, restriction LTV proportion, if they make it attract-simply money, and if he has zero minimal credit history requirements.

If you have a low or subprime credit score below 600 , you will probably you would like a private financial. Mortgage brokers may use your credit score to take on your own monetary fitness, that may lead to qualifying having a mortgage or otherwise not. Perhaps not missing any costs, which have a reduced borrowing usage rates, holding a low (or no) equilibrium for the credit cards, and having an extended credit rating will alter your credit rating.

A minimum credit score out-of 600 is required to own CMHC mortgage insurance rates. As most B Loan providers manage covered mortgage loans, being unable to be eligible for a great CMHC covered mortgage often exclude you from many B Loan providers. Lenders may also require you to get financial insurance coverage in the event you create a down payment larger than 20%.

How to consider my credit rating?

The two credit bureaus inside the Canada was Equifax and TransUnion. You could potentially request your credit score and you may credit history because of these agencies from the mail or on the web for free. Nonetheless they provide a lot more services to own a fee, including credit overseeing.

Equifax and you can TransUnion just declaration suggestions inside Canada, as they work in of a lot regions such as the You. Your credit history outside Canada might not be approved according to debt facilities. Beginners and you can brand new immigrants to help you Canada may have trouble qualifying to possess a home loan if they have a restricted Canadian credit rating.

Who will private mortgage lenders assist?

Individual mortgage lenders let fill this new gap leftover by antique lenders. Those with a finite Canadian credit score, such the immigrants, will get deal with more difficulties when trying discover home loan recognition regarding banks. Lenders can also help individuals with issues getting acknowledged getting home financing. Most other masters can be obtained with the the page throughout the home loans versus banks. At the same time, individual lenders might help another borrowers.