HELOC Compared to. Domestic Collateral Loan Closing costs: Understand the Change

Experiencing the newest guarantee of your house has a number of perks – convenient, reduced usage of financial support, probably down interest levels than many other finance and foreseeable repayments, to mention a few. And you will whether you’re given a HELOC otherwise house security financing, you ought to check out the closing costs.

Here, we will take you step-by-step through the essential difference between HELOC closing costs and you may domestic guarantee mortgage closing costs, just how much he’s, and the ways to straight down all of them or prevent them totally.

How much cash Is actually Family Guarantee Financing And HELOC Closing costs?

- App commission. Which talks about the costs out of filing the application and getting your to your program since financing buyers. This really is anywhere from $100 to help you $2 hundred.

- Notary fee. A charge you’ll want to pay to acquire certified HELOC documents notarized. Which usually will cost you regarding the $20.

- Name research. This is certainly to help the lending company be sure you are indeed the newest rightful proprietor of the home and therefore there are not any activities toward identity, such as for example outstanding fees or easements. This is from $75 to $two hundred.

- Assessment payment. An appraisal of your house is required to figure out how much you can borrow secured on the security. This is certainly from $600 to $dos,000.

- Credit report percentage. Certain loan providers can charge a fee to perform a credit assessment, charging any place in brand new $20 so you’re able to $50 diversity.

- Attorney commission otherwise document thinking payment. Before a good HELOC comes with the latest sign-off, legal counsel may prefer to review the new documents, depending on the state you’re in. Lawyer costs was 0.5% to just one.0% of your own loans Rutledge AL loan amount.

- Loan recording commission. It is a small percentage made to the brand new state recorder and you may other regional authorities They will certainly listing brand new lien that’s today facing your home. This can be anywhere from $fifteen in order to $fifty.

- Appraisal payment. An appraisal payment hinges on the location, but you can always anticipate paying $600 to help you $dos,000.

- Credit report percentage. Your financial will need to eliminate the credit reports just before granting you to possess a great HELOC. This may costs anywhere between $20 $fifty.

Ideas on how to All the way down Or Stop HELOC And you will Family Security Financing Closure Will cost you

These can cost you can also be eat into your loan fund and then have expensive over time. Listed below are some ways you can all the way down or eradicate HELOC and you can household collateral mortgage closing costs completely:

Speak about The options

Comparison shop and examine lender pricing to be certain you’re going to get an educated contract you can. Like, you can search getting lenders which may lose fees for folks who arranged autopayments. Providing rates for the very same loan amount and you can terminology might help you determine which lenders supply the reasonable interest levels.

Some lenders bring a no-closure pricing alternative on the HELOC or household equity. While this will save you for the closing costs, the lender you’ll give higher desire charges otherwise help the financing matter. It is preferable to expend close attention towards terms and you can requirements when you are planning on heading this channel.

An alternative choice? Specific lenders you will waive a number of the settlement costs and you will fees since the a special provide to get you to fund together with them.

Sign up for A smaller amount

Due to the fact closing costs is actually a portion of complete amount borrowed borrowed, a smaller home collateral financing or HELOC will reduce the borrower’s settlement costs.

Boost your Borrowing from the bank

As well as have good borrowing will most likely not always reduce your closing costs, capable help you get accepted to have all the way down rates of interest. In turn, you’ll save some bucks of the mortgage. First off, you can acquisition a credit file to discover if the there are any mistakes or discrepancies which could lower your get.

The conclusion

Getting an excellent HELOC or a home equity mortgage and you will knowing how this will impact the settlement costs you pay can also be make it easier to residential property on the best bet for you. you will must reason for any constant costs. Exploring an effective way to down or avoid closing costs entirely can make it easier to shave out of a few cash.

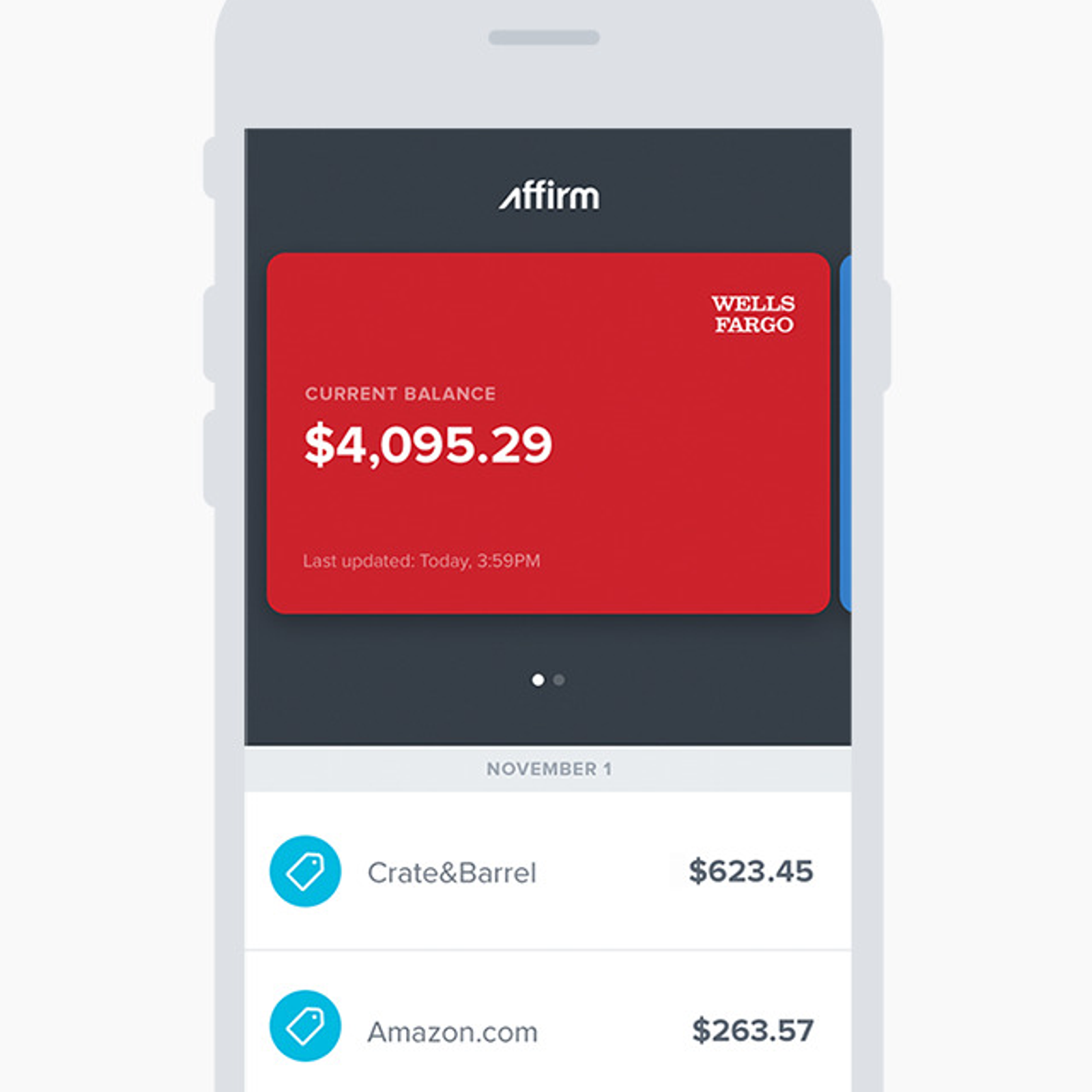

This new Rocket Money SM app offer spending information and help you stay on top away from loans payments and you may bills. If you wish to do their finances in one place, you could potentially download the brand new application now.