Are there any unique requirements having jumbo mortgages?

Down-payment the fresh new down payment required for jumbo mortgages is a lot higher than other conventional finance. According to the count need along with your credit history, you could potentially need payment of up to 20%. The fresh new deposit standards are ready from the each person home loan company out of jumbo mortgage loans. In general, the advance payment criteria are usually large to own borrowers having lower credit scores. The brand new downpayment having an excellent 550 FICO score consumers should be 30% off. Large credit history borrowers can also be be eligible for jumbo mortgage loans which have an effective 720 credit history.

Jumbo Loan Financial obligation-To-Income Standards

Debt-to-earnings (DTI) proportion ‘s the ratio between the income as well as your debt. Debt-to-money percentages is actually determined by the breaking up the full monthly minimum obligations payments. The new gross income can be used so you can estimate income. If you are searching to possess an effective jumbo mortgage., the team from the Gustan Cho Partners can help you having dozens regarding home loan choices.

I have more than 190 general lending people. Certainly all of our credit community, we shall try to enable you to get the best prices compared to any other lending company. Home loan underwriters are concerned throughout the borrowers with highest financial obligation-to-earnings percentages towards the jumbo mortgages. Gustan Cho Associates has actually a distinct segment out of old-fashioned jumbo lenders one to goes doing a 50% debt-to-earnings proportion.

The truth is, if financial feels that there’s a greater exposure when you look at the credit the bucks, they may need particular most conditions, which include:

You will be Needed to Have Cash Reserves

- Also examining the DTI ratio, the financial institution you’ll ask you to provide financial comments to show which you have money in your account to steadfastly keep up the brand new costs.

- Depending on the lender, reserves may be required.

- Supplies can range from that 12 months out of supplies according to bank.

- Supplies can’t be gifted

- All the supplies have to be borrower’s very own financing

Home loan Rates and you will Closing costs for the Jumbo Mortgages

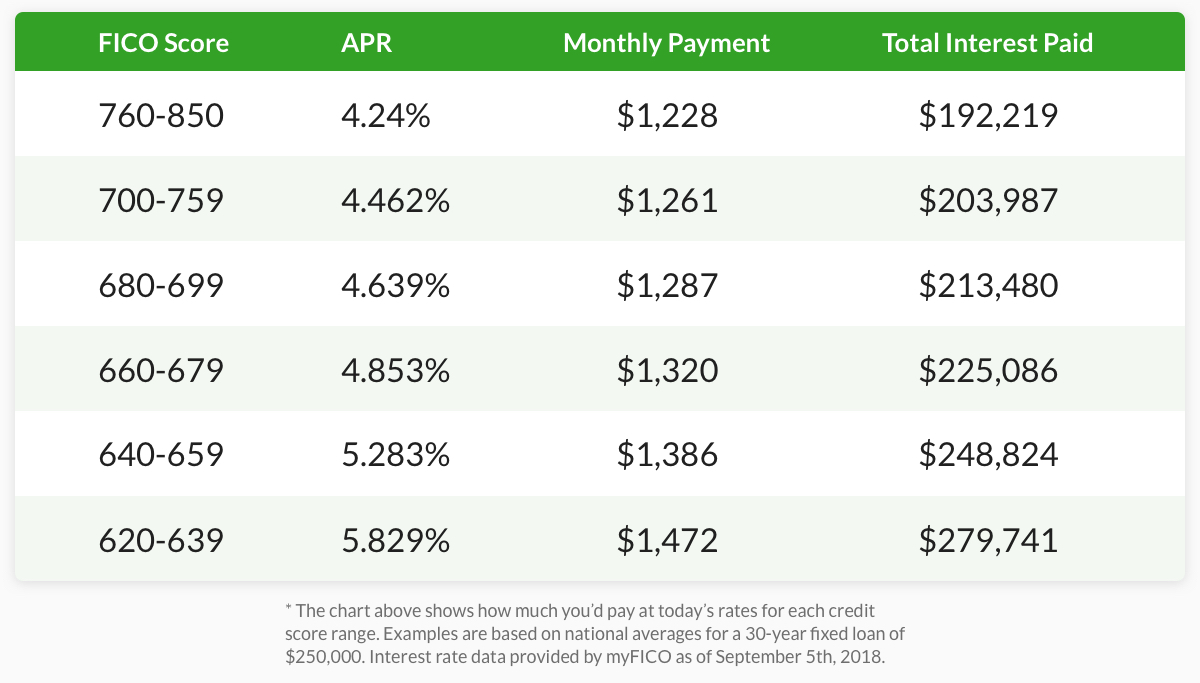

Financial costs on the jumbo mortgages are usually more than conforming financing. Mortgage lenders usually legs the fresh rates for the prices to your a good jumbo mortgage centered on what sort of financing peak costs modifications (LLPA). LLPAs is costs moves in line with the borrower’s exposure situations. All the way down credit scores will surely provides a rates struck into the speed. The expenses and you will fees are going to be high on the jumbo mortgages rather than conforming finance. On average , the new settlement costs getting mortgage loans is actually anywhere between 2 and 6 %. Yet not, regarding higher-exposure jumbo mortgages, the costs you are going to meet or exceed six percent of the complete family well worth.

Uniform earnings

Besides checking the debt-to-money proportion, the lender could need to understand in case the revenue stream was legitimate and you can typical. So, in connection with this, she or he requires records indicating money provider was unlikely to switch for another three years. Homeowners which plan on to get their forever advancing years household doesn’t manage to be eligible for an excellent jumbo mortgage loan whenever they change promote recruiting of the company progress find to your whenever they’ll certainly be retiring.

Guidelines underwriting

All of the jumbo mortgage loans are manually underwritten. Borrowers are needed to offer the mortgage processor chip on the requested data files required for the fresh new chip for all of them ready getting the borrowed funds underwriter. All the data which you promote might be searched and verified getting authenticity. The financial data wanted to the lender is carefully checked https://paydayloanalabama.com/vernon/ and you can reviewed from the tasked mortgage underwriter.

The borrowed funds underwriter ‘s the person that will try to see in the event that there have been one missteps economically in earlier times. When they get a hold of one, you will find difficulties acquiring home financing. Although not, for many who fulfill the financial recommendations plus the lender’s individual inner conditions, you’re issued a conditional real estate loan acceptance.